P = [3.5000 1.1100 1.1100 1.0400 1.0100;

0.5000 0.9700 0.9800 1.0500 1.0100;

0.5000 0.9900 0.9900 0.9900 1.0100;

0.5000 1.0500 1.0600 0.9900 1.0100;

0.5000 1.1600 0.9900 1.0700 1.0100;

0.5000 0.9900 0.9900 1.0600 1.0100;

0.5000 0.9200 1.0800 0.9900 1.0100;

0.5000 1.1300 1.1000 0.9900 1.0100;

0.5000 0.9300 0.9500 1.0400 1.0100;

3.5000 0.9900 0.9700 0.9800 1.0100];

[m,n] = size(P);

Pi = ones(m,1)/m;

x_unif = ones(n,1)/n;

cvx_begin

variable x_opt(n)

maximize sum(Pi.*log(P*x_opt))

sum(x_opt) == 1

x_opt >= 0

cvx_end

R_opt = sum(Pi.*log(P*x_opt));

R_unif = sum(Pi.*log(P*x_unif));

display('The long term growth rate of the log-optimal strategy is: ');

disp(R_opt);

display('The long term growth rate of the uniform strategy is: ');

disp(R_unif);

rand('state',10);

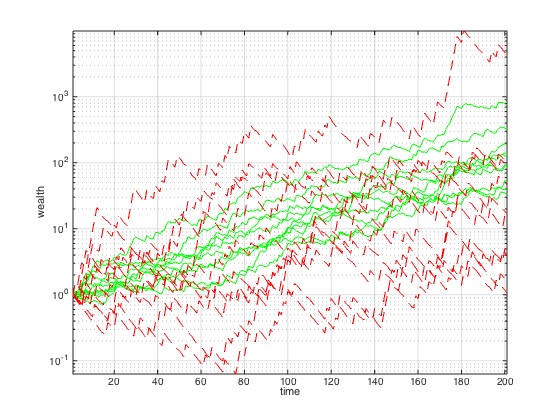

N = 10;

T = 200;

w_opt = []; w_unif = [];

for i = 1:N

events = ceil(rand(1,T)*m);

P_event = P(events,:);

w_opt = [w_opt [1; cumprod(P_event*x_opt)]];

w_unif = [w_unif [1; cumprod(P_event*x_unif)]];

end

figure

semilogy(w_opt,'g')

hold on

semilogy(w_unif,'r--')

grid

axis tight

xlabel('time')

ylabel('wealth')

Successive approximation method to be employed.

For improved efficiency, SDPT3 is solving the dual problem.

SDPT3 will be called several times to refine the solution.

Original size: 36 variables, 15 equality constraints

10 exponentials add 80 variables, 50 equality constraints

-----------------------------------------------------------------

Cones | Errors |

Mov/Act | Centering Exp cone Poly cone | Status

--------+---------------------------------+---------

10/ 10 | 1.166e+00 9.529e-02 0.000e+00 | Solved

10/ 10 | 1.083e-01 9.046e-04 0.000e+00 | Solved

10/ 10 | 2.870e-03 6.340e-07 0.000e+00 | Solved

0/ 0 | 0.000e+00 0.000e+00 0.000e+00 | Solved

-----------------------------------------------------------------

Status: Solved

Optimal value (cvx_optval): +0.0230783

The long term growth rate of the log-optimal strategy is:

0.0231

The long term growth rate of the uniform strategy is:

0.0114